Playbook

A drug that prevents Human Immunodeficiency Virus (HIV) is out of reach due to cost for many people who could benefit . The treatment known as pre-exposure prophylaxis (PrEP) significantly reduces the risk of contracting HIV. However, market dynamics involving the research and development (R&D) process, marketing, and acquisition contribute to promoting two higher-priced, brand-name versions of PrEP, even though less expensive generics are available.

This playbook traces the path to market of the two drugs, Truvada and Descovy, to understand the factors that influence the cost and availability of these drugs.

What is "Product Hopping"?

One way drug companies keep patients from switching to a generic competitor is by "product hopping." This refers to a strategy in which a manufacturer introduces a new drug with minor product reformulations to maintain a dominant share of the market. With PrEp, Gilead introduced Descovy near the time when Truvada’s patent expired and proactively promoted switching patients to the newer drug just before generics for Truvada were set to enter the market.

Click through the development timeline to see how product hopping extends a company's hold on a drug market.

From Production to Patient

How cost results in low uptake for an effective treatment. Market incentives, including decisions by the manufacturer and the needs of certain hospitals and clinics, influence the cost and availability of HIV prevention medication to patients.

Learn about the key factors that influence drug prices:

Research & Development

Two Promising Drugs but Delayed Studies of One

As Gilead worked on developing Truvada, it also conducted clinical trials on a modified version, which would later become Descovy. However, Gilead delayed further research on this new product, despite previous demonstrations on its success.[5]While Truvada was on the market, the company also applied for patent protections for the new product, which positioned Gilead to begin selling Descovy just ahead of when the company expected generic competitors of Truvada to hit the market.

Research & Development

“Product Hopping” is Used to Maintain Market Share

In 2019, Gilead launched Descovy, allowing the company to transition patients on Truvada to its new drug ahead of the first Truvada generic launch in 2020.[6] This practice, when a manufacturer selectively introduces a new drug that features minor product reformulations to thwart generic competition, is often called “product hopping.” With PrEp, the practice of switching patients from Truvada to Descovy ahead of generics’ launch, diminished use of lower-cost generics. Product hopping is common [7] and has profound implications for what patients pay at the drug counter. One analysis estimates that the cost of product hopping for five brand-name drugs costs the U.S. healthcare system $5 billion annually. [8]

Marketing

Marketing Strategies Focused on Patients Switching to Descovy

As Gilead prepared to launch Descovy, it focused marketing efforts on providers and consumers of the benefits of the new drug to capture patients who could have switched to generic Truvada. “What seems to be happening is that doctors are being encouraged to switch patients to Descovy based on the surface impression that it has a better safety profile, but for most of us, generic Truvada is perfectly safe. The switch to Descovy has more to do with Gilead trying to hold onto its market share of PrEP users in the face of generics,” said Kenyon Farrow of advocacy group PrEP4All. [9] Gilead transitioned 49% of Truvada utilization to Descovy, according to Part D data, even though the switch from Truvada to Descovy was found to be unwarranted in five of six switches, on average. [10 11]

Patient Access

Most People Who Could Benefit from PrEP Are Shut Out

When taken daily, PrEP reduces the risk of contracting HIV through sex by 99% and through intravenous drug use by 74%.[12] Despite the high efficacy rates, nearly three-quarters (73%) of individuals who could benefit from PrEP have not been prescribed the medication. [13] Further, the rate at which patients have switched from brand-name drugs to less expensive generic alternatives has been very low, despite the high cost of Truvada ($22,415) and Descovy ($24,807). [14]

Acquisition

Incentive Programs Inadvertently Discourage Use of Lower-Cost PrEp

The 340B federal drug pricing program is designed to support the health needs of vulnerable populations. Under the program, organizations such as safety net hospitals and clinics can obtain PrEp at steeply discounted prices. They are reimbursed per the terms of the payer, whether it’s Medicare, Medicaid or commercial insurance. The organizations then use the difference between the lower purchase price and higher reimbursement to meet the needs of low-income patients. [15] Because the difference is greater when prescribing more expensive drugs, the hospitals and clinics lean toward the use of Truvada and Descovy over generics. While in many settings, including Federally Qualified Community Health Centers and clinics enrolled in the Ryan White program, this is done to achieve an overall net positive impact on care for vulnerable patients, it nonetheless shapes the pricing dynamic. [16]

Distribution

Coverage Determinations May Cause Unequal Access and Increase Patient Costs

In 2020, the U.S. Preventive Services Task Force (UPSTF) gave Truvada an “A” recommendation. [17]Under the Patient Protection and Affordable Care Act (ACA), that means at least one PrEP option (e.g., Truvada or generic) must be covered without cost-sharing to enrollees in most private health insurance plans. [18]Prior to this recommendation, the high list price for PrEp meant patients often needed to seek prior authorization or use a special mail-order pharmacy to get their medication. [19]While this is an improvement for Truvada, as of August 2023, Descovy had not yet been officially included in the recommendation and may still be subject to prior authorization and co-pays.

Distribution

Cost of Doctor Visits Adds Barriers to PrEp Usage

PrEp is only available by prescription meaning, a prospective patient must be seen by a licensed health care provider and test negative for HIV. Patients also likely need to see their provider every three months to continue receiving the medication. This high level of engagement with a provider may create structural or logistical barriers to accessing PrEp, and it may also impact the patient’s out-of-pocket costs. Co-pays for visits, lab tests, and filling the prescription indefinitely will add up. Taken alongside the price of PrEp, the added costs may further inhibit starting or continuing treatment.

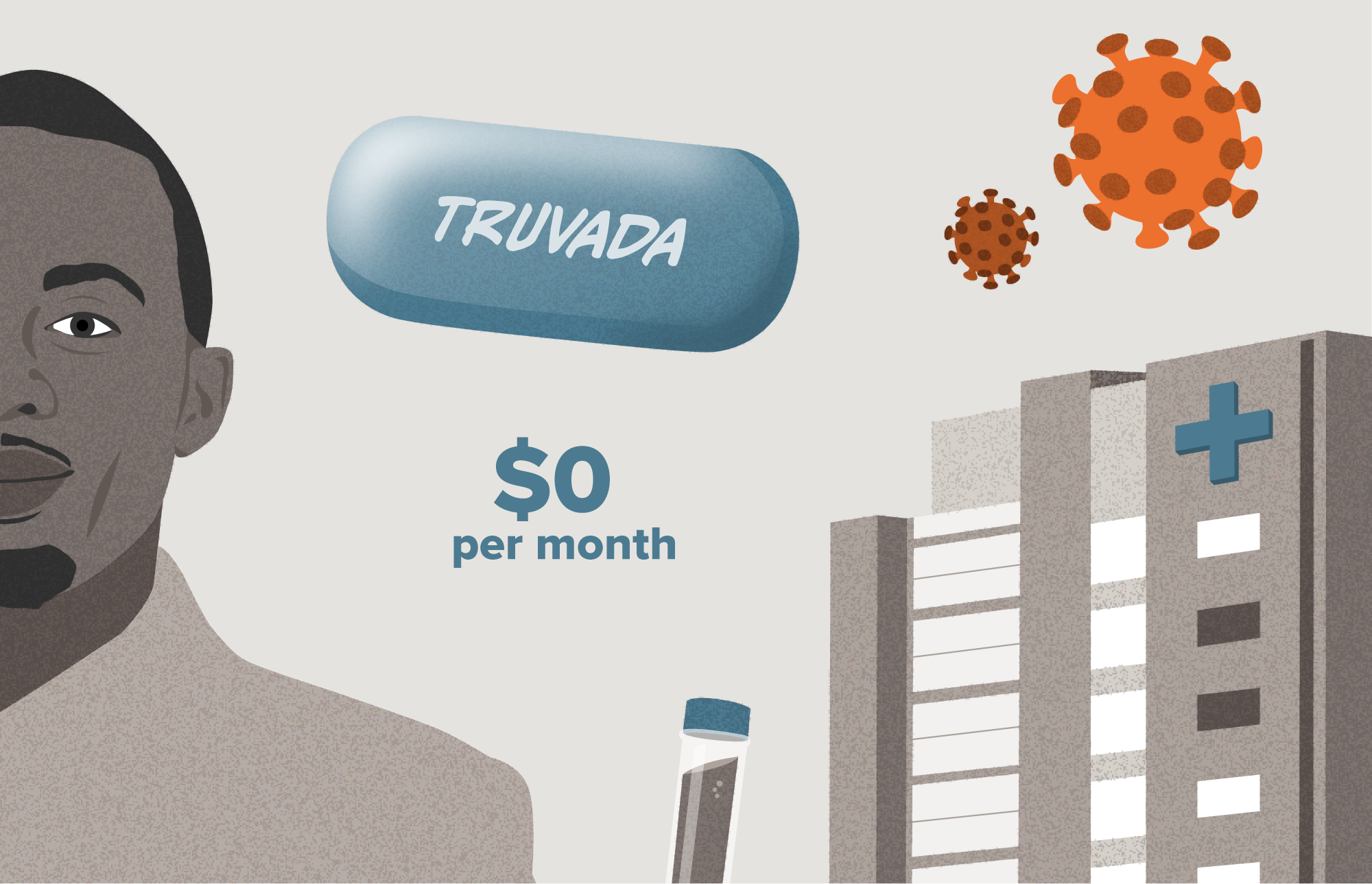

Visualizing the Patient Journey

In the scenarios below, we follow a man who is seeking a prescription for PrEP. He is enrolled in a high-deductible health plan through employer-sponsored insurance and has access to a few care settings in his local area such as a Ryan White clinic and an independent primary care practice, both of which provide HIV care. These scenarios will differ primarily on the financial structure and incentives of the care setting to acquire and prescribe specific PrEP treatments. The scenarios result in substantially different out-of-pocket drug costs for the patient.

Here we look at a patient who is seeking preventative treatment for HIV, and is interested in a prescription for PrEP.

Note: Patient scenarios are meant to be illustrative only. Prices are based on publicly available information when possible and good-faith estimates when prices were not available.

Market Incentives Hold Back HIV Prevention

PrEP is an effective tool for preventing the spread of HIV. However, strategies employed by the leading manufacturer of branded PrEP medications, as well as legal and market structures, mean many people eligible for treatment experience barriers to taking it.

Patient Costs Vary Widely

The same patient with the same condition and insurance coverage can experience two drastically different costs based on where they seek care.

Generics Losing the Competition

Truvada has a dozen generic competitors, but some patients continue to be prescribed the expensive brand name alternatives because of legal business practices and incentives.

Pathway to Ending the HIV Epidemic

Continuing to find ways to make PrEP and other preventative drugs affordable for more people will be key for the U.S. to reach its goal of ending the HIV epidemic.